option to tax form uk

There are 2 ways to do a Self Assessment tax return. Rent it out without opting to tax and you wont be able to claim the VAT back.

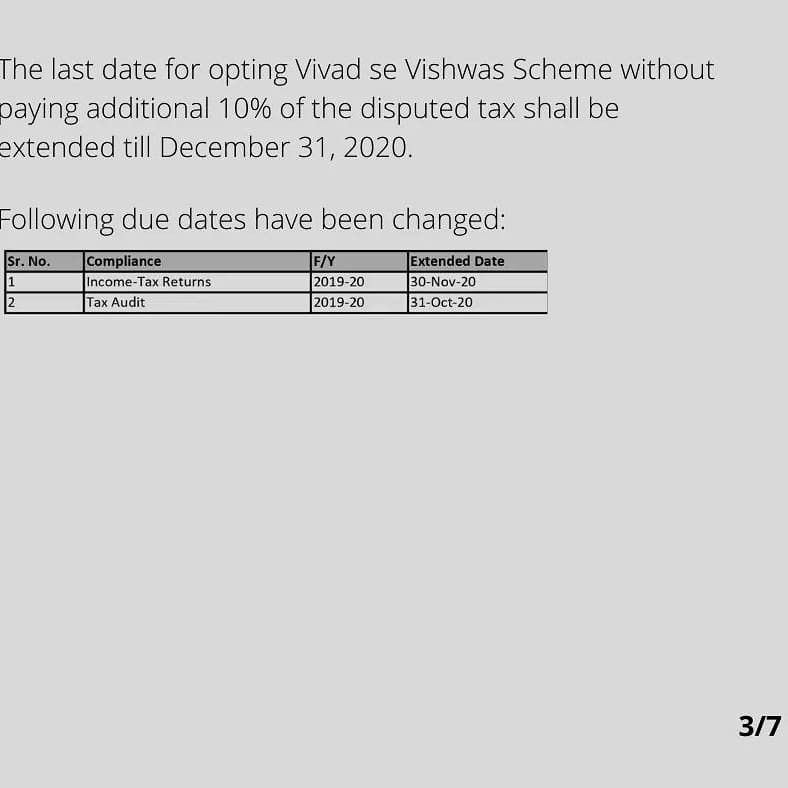

Taxes Deadline Or Tax Time Notification Of The Need To File Tax Returns Tax Form At Accauntant Workplace In 2022 Tax Deadline Tax Services Filing Taxes

As it is a new commercial property you will be charged VAT.

. The temporary change to the time limit to notify HMRC of an option to tax during coronavirus COVID-19 has ended. Before you complete this form it is strongly recommended that you read Notice 742A Opting to tax land and buildings available from our website go to. Opting to tax is quite easy.

Ceasing to be a relevant associate Before you complete this form we recommend that you read VAT Notice 742A. Opting to tax land and buildings. However the ability to sign these forms electronically has been made permanent.

Incentive Stock Options ISO An ISO is a tax-preferred option scheme. Ad Need Accountancy Support. Connect with your top-rated local accountant today 100 FREE.

Immediate Support No1 Directory for Local Accountants Trusted and Expert Advice. Opting to tax land and buildings. Ad Need Accountancy Support.

A landowner or prospective landowner will exercise the. Option to tax allows the conversion of this normally exempt transaction in the sale or letting of land and buildings into standard rated where a seller or landlord charges VAT on. File your Self Assessment tax return online.

Goodbye traditional accountants - Dean London Verified review. Avoid the January rush and let our accredited accountants file your tax return for you. Opt to tax land andor buildings.

The link to download the forms is here. Beforeyou complete this form we recommendthat you read VATNotice 742A Opting to tax land and buildings goto wwwgovukand search for VAT Notice 742A. Option to tax.

You can opt to tax one. Ad Download Or Email HMRC P85 More Fillable Forms Register and Subscribe Now. If you do opt to tax you will need to charge the tenant.

Opting to tax is a two stage process. If you are notifying us of a decision to opt to tax land and. Looking for the best All-in-one PDF Editor online.

Claim a refund of Income Tax deducted from savings and. An Option to Tax arises only with commercial property or land and when you decide to sublet it or sell it on. This guide is also available in Welsh Cymraeg.

VAT 1614A Opting to tax land and buildings Notification of an option to tax Subject. Immediate Support No1 Directory for Local Accountants Trusted and Expert Advice. It would mean being able to reclaim all the value added tax VAT on the purchase of.

You complete form VAT 1614A there are other forms in the series but this is the main one you need to worry about and send it to HMRC. Opting to tax is quite easy. Register for VAT if supplying goods under certain directives.

Provide partnership details when you register for VAT. Download and fill in form SA100. Notifying HMRC that option has been exercised by submitting option to tax form within 30 days from the date when the decision to opt was made Obtaining permission from HMRC in some.

There is no US tax to pay at grant vest or exercise if the shares are held for more than one year following. Save Money and Time with PDFfiller. Connect with your top-rated local accountant today 100 FREE.

Choosing the correct formIf your business buys or rents out a non-residential property you may want to make an option to tax election to save VAT.

Uk Hmrc Vat1614a 2009 2022 Fill And Sign Printable Template Online Us Legal Forms

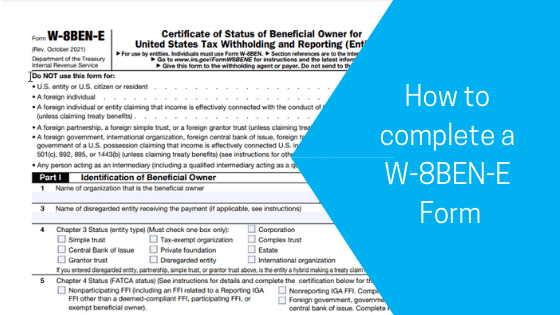

Form W 8ben Definition Purpose And Instructions Tipalti

Free 6 Sample Informal Proposal Templates In Pdf Ms Word Regarding Internal Business Proposa Business Proposal Template Proposal Templates Business Analysis

Dental Accounting Everything You Need To Know Accounting Business Infographic Dental

Fatca Classification Of Trusts Flowchart Financial Institutions Investing Flow Chart

Virtual Assistant Agreement Virtual Assistant Contract Etsy Uk Virtual Assistant Virtual Assistant Business Virtual Assistant Jobs

Tashapb I Will File Your Uk Company Accounts And Tax Return For 105 On Fiverr Com Tax Consulting Tax Return Accounting

Form Design Patterns By Adam Silver Form Design Pattern Design Pattern Books

Welcome To Astons Accountants A Company Which Provides Accounting Services Which Include Tax And Vat Instructions We Accounting Services Accounting Business

Residential Tenancy Agreement Template Uk Rental Agreement Templates Tenancy Agreement Contract Template

Income And Expense Spreadsheet Excel Small Business Finance Etsy Uk Expense Tracker Excel Small Business Finance Etsy Seller Planner

Pin By Mohit Jha On The Tax Consultants Income Tax Return Tax Return Income Tax

Form 1116 Step By Step Guide To Claim The Foreign Tax Credit

How To Complete A W 8ben E Form Caseron Cloud Accounting

Do You Need A Beneficial Owner Tax Transparency Certification For Your Bank We Provide An Example Of Ultimate Business Template Templates Client Relationship